From Panic to Power: Reclaiming Control After a Phone & Credit Card Breach

By: Javid Amin

In today’s digital world, where convenience often collides with security risks, falling victim to a phone compromise or credit card hack can be a stressful and costly experience. Imagine receiving a call claiming your gas service will be disconnected if you don’t pay an outstanding bill immediately. Alarmed, you follow the caller’s instructions, only to discover later that your phone was compromised, your credit card hacked, and thousands of rupees have vanished. This is the unfortunate reality Aandeep Sethi, a resident of Dwarka, faced.

The Story of Aandeep:

Aandeep’s story serves as a stark reminder that even the most vigilant individuals can be targeted by cybercriminals. What started as a seemingly legitimate call regarding an overdue bill turned into a financial nightmare. The key takeaway: immediate action is critical. Aandeep’s swift response to the situation by contacting his bank and filing a report showcases the importance of staying calm and taking decisive steps.

Recovering from the Breach: A Step-by-Step Guide

Fortunately, there are ways to fight back and potentially recover your stolen funds. Here’s a detailed breakdown of the steps you should take if you suspect your phone or credit card has been compromised:

- Act Fast: Contact Your Bank Immediately Time is of the essence. As soon as you suspect suspicious activity, don’t hesitate! Contact your bank’s customer service department through a verified phone number (listed on your bank’s official website or mobile app). Explain the situation in detail and report any unauthorized transactions you see on your statements.

- Freeze or Cancel Your Compromised Accounts To prevent further fraudulent activity, request your bank to freeze or cancel your compromised accounts. This could involve your credit card, debit card, or even online banking access. Banks may offer temporary account numbers while they investigate the situation.

- Monitor Your Statements Vigilantly Become a hawk! Scrutinize your bank and credit card statements for any unrecognized transactions, even small ones. Early detection can significantly increase your chances of recovering stolen funds.

- File a Police Report: While not always mandatory for a bank investigation, filing a police report can strengthen your case. It creates a formal record of the incident and might be helpful if law enforcement manages to track down the perpetrators.

- Dispute Unauthorized Charges: Work with your bank to dispute any unauthorized transactions identified in your statements. They will likely launch an investigation into these charges, and you might receive a temporary credit on your account while they determine the legitimacy of the transactions.

- Leverage Your Bank’s Security Measures: Many banks utilize sophisticated security systems with features like Open-Source Intelligence (OSINT) technology to analyze transactions and identify suspicious activity. These safeguards can help detect fraudulent activities in real-time, minimizing potential damage.

Protecting Yourself from Future Attacks:

Prevention is always better than cure. Here are some proactive measures you can take to safeguard your phone and credit card from future compromise:

-

Strong Passwords & Multi-Factor Authentication (MFA):

Create strong, unique passwords for all your online accounts. Enable Multi-Factor Authentication (MFA) whenever possible. This adds an extra layer of security by requiring a second verification code (usually sent via SMS or a dedicated app) before logging in. -

Keep Software Updated:

Outdated software can contain vulnerabilities that hackers exploit. Make sure your phone’s operating system and apps are updated with the latest security patches. Both phone manufacturers and app developers regularly release updates to address security concerns. -

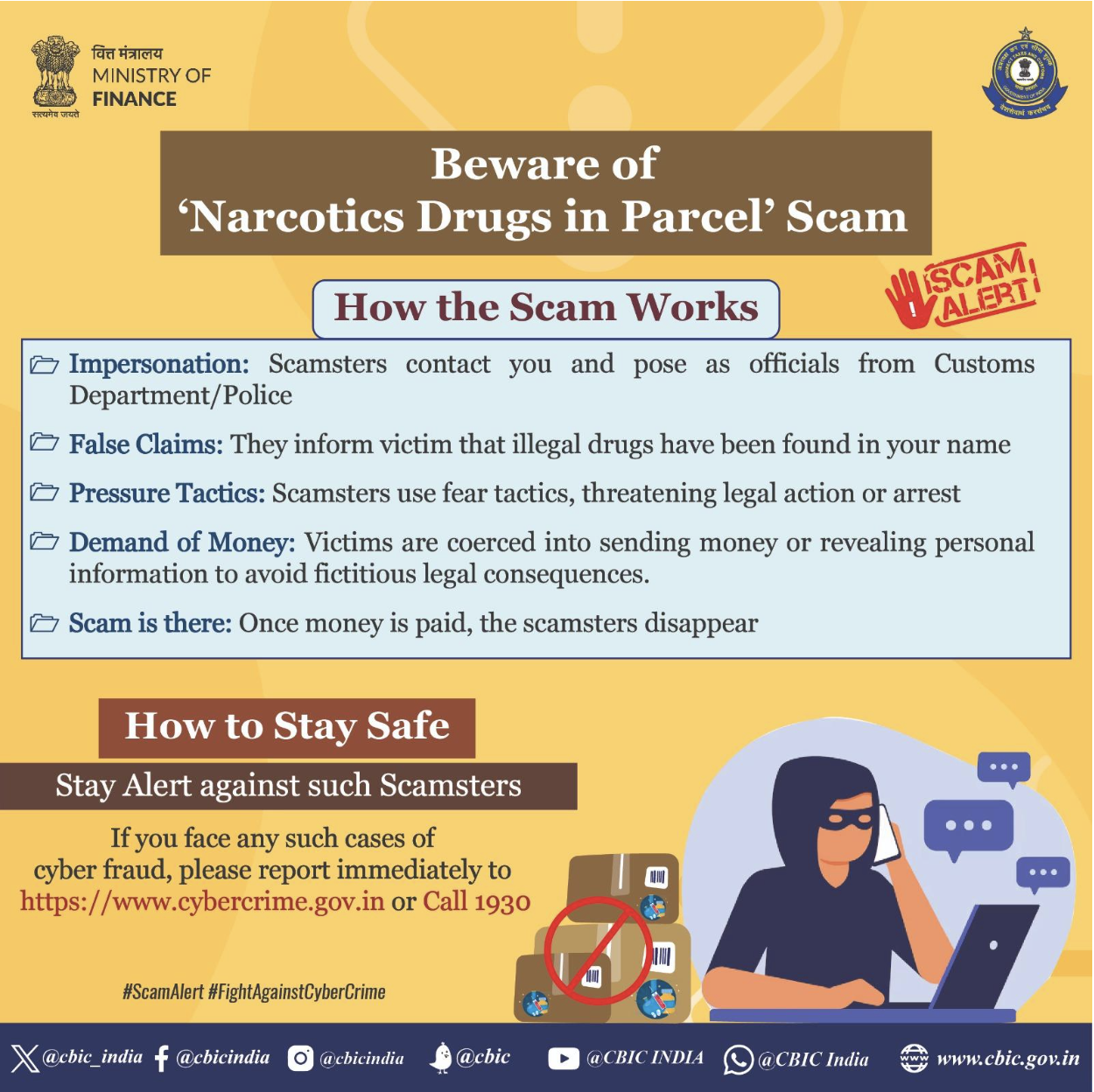

Beware of Phishing Scams:

Don’t click on suspicious links or attachments in emails or text messages. Phishing scams often try to trick you into revealing personal information or clicking on malicious links that can compromise your phone. Be cautious about unsolicited calls claiming to be from banks, credit card companies, or utility providers. -

App Permissions:

Be mindful of the permissions you grant to apps on your phone. Only give apps access to the information they absolutely need to function. Avoid granting excessive permissions that could put your data at risk. -

Public Wi-Fi Caution:

Avoid using public Wi-Fi for sensitive activities like online banking or accessing financial accounts. Public Wi-Fi networks are often unsecured and can be easily exploited by hackers to steal your data. Consider using a Virtual Private Network (VPN) for added security when using public Wi-Fi. -

Regular Monitoring:

Develop a habit of regularly reviewing your bank and credit card statements. This vigilance can help you identify unauthorized transactions early on, allowing you to take swift action and minimize potential losses.

Bottom-Line:

By understanding the risks and taking proactive security measures, you can significantly reduce your chances of falling victim to phone and credit card hacks. Remember, if you do encounter a compromise, don’t panic! Act quickly, follow the steps outlined above, and stay vigilant in monitoring your accounts. Working collaboratively with your bank and taking advantage of their security features can help you recoup lost funds and regain peace of mind.

Call to Action: Empower yourself and your loved ones with knowledge. Share this information and spread awareness about cybersecurity best practices. Let’s work together to create a safer digital environment for everyone.